28 February, 2012

Greece a default grade risk, and this is news ?

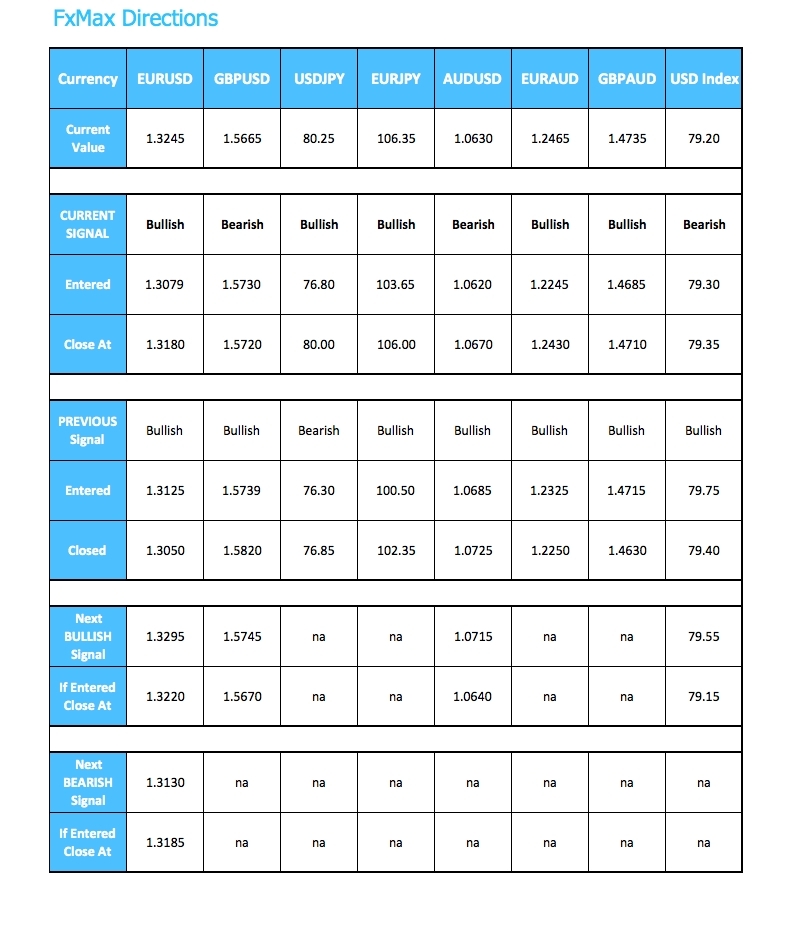

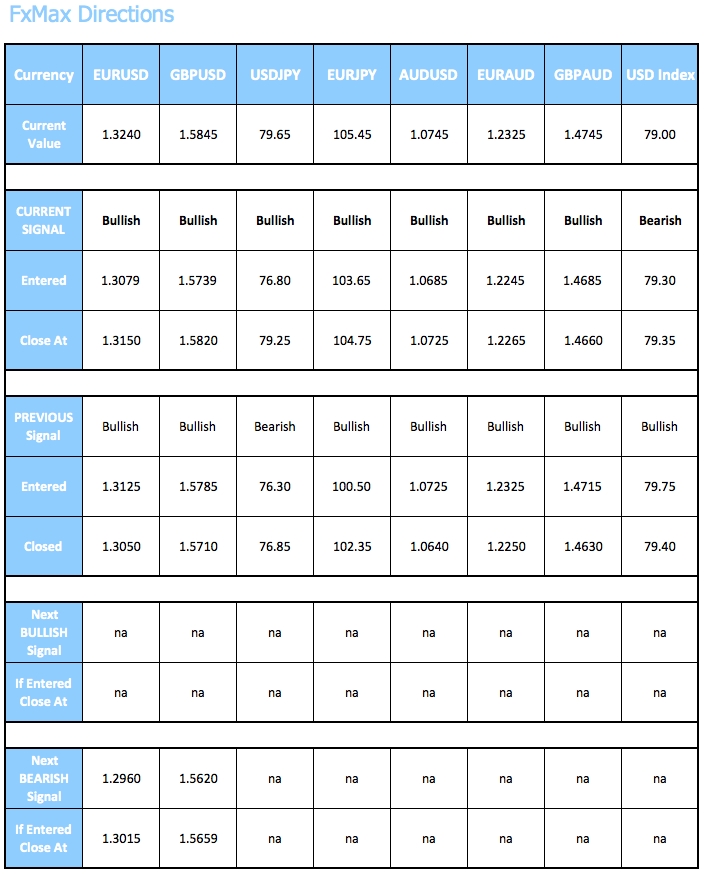

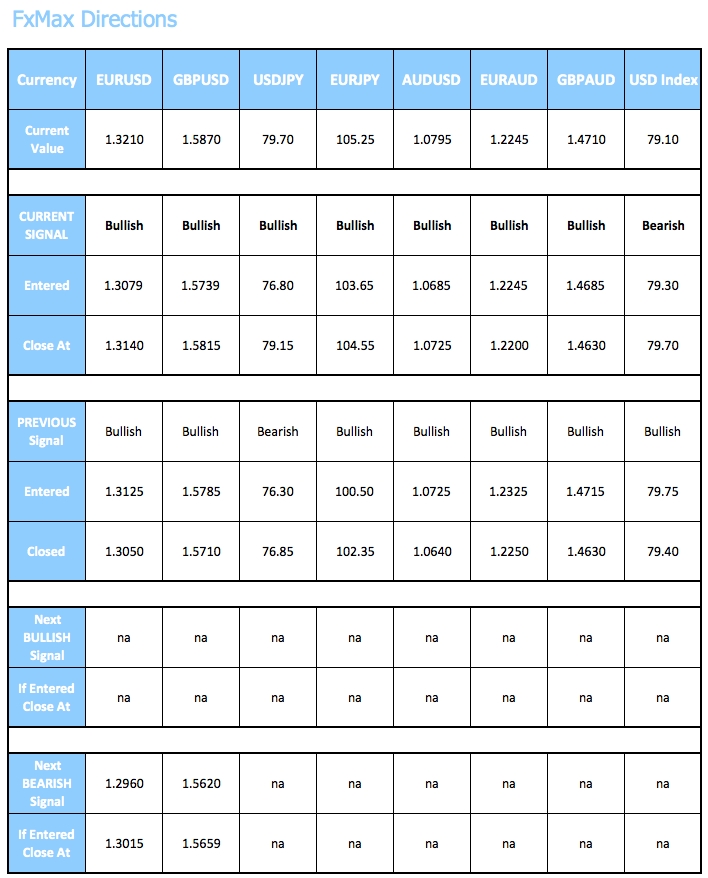

The pullback in the Euro, and small bounce in the US dollar will be incredibly short lived. How bizarre that the market would react to anything S&P says in the first place, and then to suggest that Greece as a default grade risk of any form is actually news and a surprise that needed to be priced into the Euro. This is ridiculous of course, and we can expect to see an almost immediate recovery of the Euro. In fact the low of this very modest pullback, in comparison to the strong rally now in place, has likely already been seen.

Suggest continued buying of the Euro on any and all dips!

The whole world, from farmers to dentists, from China to Uruguay, knows that Greece is having a planned and managed partial default. This is most definitely not news, and has been more than fully priced into the market for some time. It really seems to have been a case of "there was not much else happening on the day", so let’s try to sell the Euro again!

Well it hasn’t worked very much at all, and now a whole host of day traders are short, and the market is again bid. As soon as some large investors recognize this as the dip to buy, that it is, we should see yet another sharp rally.

The Australian dollar has bottomed, and will either go sideways for a while to consolidate, or just shoot straight up. The Euro and the Australian dollar can be expected to play leap frog throughout the year against a continuing decline in the value of the US dollar.

Clifford Bennett

Chief Economist

White Crane Group

White Crane Group

Clifford Bennett

Chief Economist

White Crane Group

Sydney, Australia.

+61 (0) 423 950 427

clifford@whitecranegroup.com.au

www.whitecranegroup.com.au